By Owen I.L. Bernard II

Edited by Alexander H. Yazdani

Description

Knowles Corp (KN) represents a lucrative holding to date; market price ~ $19. There is a growth story within the micro electro-mechanical systems tech space especially this global market leader in micro acoustics with 60% of the market share. The market is uncertain of whether this type of growth story is one shared by the historical competitive performance of the automobile and airline industry, creative destruction. With significant market share, the company generates stable operating cash flow and produced strong growth in terms of unit volume and top-line revenue among their operating segments. The company has high returns on capital, which not reflected in most institutional screens due to conservative GAAP SG&A reporting by the company; marginal returns on capital are similarly as high against the company's reinvested earnings. Valuation in terms of discounted cash flow, the company is trading at 40%-50% of its worth. A conservative 12x multiple on unlevered 2015 eps, I estimate a worth of at least $40. Given the valuation guidance, the market price should double over the next two years as shipment issues are resolved and market share normalizes.

The market is overvaluing the risk of new entrants potentially resulting in lost market share decreasing KN's hold from 80% in 2009 to currently 60% due to temporary shipment issues to a top-tier client. This along with the "risk-on" perspective by market participants and the fear of a macro bubble touted by pundits.

Overview of Ops. & Rev. By varying factors

Knowles designs the acoustics in a number of mobile devices, medical devices for large clients like Apple and Samsung.

Customers, Sales and Distribution - We serve customers in the mobile consumer electronics, medical technology, defense/aerospace, telecommunication infrastructure and other industrial markets. Our customers include some of the largest operators in these markets. In addition, many of our OEM customers outsource their manufacturing to Electronic Manufacturing Services (“EMS”) companies. Other customers include global mobile phone and hearing aid manufacturers and many of the largest global EMS companies, particularly in China. For the year ended December 31, 2014, Apple, Inc. and Samsung Group accounted for approximately 20% and 12%, respectively, of our total revenue. For the year ended December 31, 2013, Apple, Inc. and Samsung Group accounted for approximately 25% and 15%, respectively, of our total revenue. For the year ended December 31, 2012, Apple, Inc. accounted for 18% of our total revenue. No other customer accounted for more than 10% of total revenues during these periods.

Knowles supplies, for instance, two of the three high-performance MEMS microphones in Apple’s iPhone 5s, as well as one of three in the iPhone 5. The product sale are made directly to original equipment manufacturers and to their contract manufacturers and suppliers and to a lesser extent through distributors around the world.

Operating Divisions

- Mobile consumer electronics - Includes analog and digital microphones, MEMS microphones, surface mounted device microphones, receivers, speakers, integrated modules, multi-functional devices, ultrasonic sensors and integrated audio sub-systems. MCE designs and manufactures innovative acoustic products, including microphones, speakers, receivers and integrated modules used in several applications that serve the handset, tablet and other consumer electronic markets. Locations include the corporate office in Itasca, Illinois; sales, support and engineering facilities in North America, Europe and Asia; and manufacturing facilities in Asia.

- Specialty Components - Includes transducers, oscillators, capacitors and filters. SC specializes in the design and manufacture of specialized electronic components used in medical and life science applications, as well as high-performance solutions and components used in communications infrastructure and a wide variety of other markets. SC’s transducer products are used principally in hearing aid applications within the commercial audiology markets, while its oscillator products predominantly serve the telecom infrastructure market and its capacitor products are used in applications including radio, radar, satellite, power supplies, transceivers and medical implants serving the defense, aerospace, telecommunication and life sciences markets. Operating facilities and sales, support and engineering facilities are located in North America, Europe and Asia.

The company benefits from higher value-added components that generate larger premiums and margins. Knowles benefits from mobile device manufacturers integrating multiple acoustic components per device for improved functionality and performance due to end user demand, further improving sales volume. New market trend concepts developing are the wearable technology markets that many deem to be the next area of rapid expansion.

List of potential client base:

U.S. based manufacturers:

International manufacturers:

Specialty Components products are sold across diverse end markets and relative to the Acoustic Components end markets, portions of this business face much greater exposure to capital investment cycles and government spending, both direct and indirect, as some of these end markets are largely dependent on project upgrades, expansion and government contracts. These products can be divided into the following categories:

- Medical and life sciences products (i.e., transducers, hearing aids, capacitors). Product sales are largely driven by aging demographics, healthcare spending, the rise of a middle class in emerging markets and government subsidies.

- Aerospace and defense communications (i.e., capacitors, filters, oscillators). Aerospace and defense spending and automation (largest end market), telecom regional coverage and bandwidth expansion and growing industrial power supply requirements are a few of the end market trends driving the product sales in this sector.

- Telecom infrastructure (i.e., capacitors, filters, oscillators). Sales are typically levered to the expansion of large telecom companies, looking to increase wireless signal in new or existing territories, although these products are also sold to aerospace and defense companies (i.e., airplane radio frequencies).

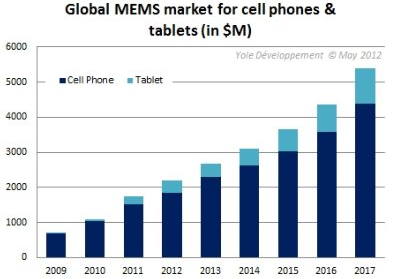

Acoustic component sales are driven by developments in smartphone and tablet innovation and demand trends. Higher-performance passive acoustic components and active audio chipsets are needed to keep up with discriminating consumer expectations. Over the past five years, the rapid growth of smartphones increased the demand for high-value audio components, much more so than the earlier generations of cellphones. Newer adopted standards, like 4G technology, also buoy the need for high-end chipsets. The rollout of 4G in China and expansion of the coverage profile in the U.S., Japan, Korea, and Northern Europe should foster demand for Knowles’ inventory, even though there is already deep market penetration in some developed regions.

Competitve Landscape

The company’s competitive position rests on its ability to continue successfully innovating widely adapted products. Because many of its components are designed specifically for a manufactures product, Knowles is relying on that finished product to be commercially successful. Changes in usage or expected end-user demand can lead to obsolete inventory lingering on the balance sheet.

Success in the electronic components industry is primarily driven by innovation and flexibility as customers compete to gain a share of the growing consumer device market. We compete across handset, tablet and other consumer platforms to deliver superior acoustic performance through customized products. Continuous investment in research and development enables us to capture new design wins across consumers. Flexibility in balancing full and semi-automation is key to achieving a superior cost structure. Additionally, it is important for suppliers to have flexibility and quick time-to-market to meet clients’ needs. Notably, according to industry estimates, the product cycle for handsets has shortened over recent years. Key competitors include:

MCE- AAC Technologies, Goertek, ST Micro and Invensense;

- SC- Sonion, Rakon, Kyocera, and Epson Electronics.

Among microphone suppliers, Illinois- based Knowles remained far and away the leader, even managing to increase its revenue share last year to 59 percent, up from 55 percent in 2012. Knowles has been particularly successful in growing its business, via high-performance microphones priced at a premium, for Samsung and particularly for Apple, which is the leading buyer of MEMS microphones and dictates supply chain dynamics in the area. Knowles supplies, for instance, two of the three high-performance MEMS microphones in Apple’s iPhone 5s, as well as one of three in the iPhone 5.

Reason for Opportunity

Recent issues with product distribution for largest client

Recovery from low production volume from Blackberry & Samsung due to shift in market share

From Taxes to R&D

The effective tax rates for 2014, 2013 and 2012 were 57.9%, (4.2)% and (0.2)%, respectively. The resulting tax

Knowles Conducts research worldwide to discover and develop new acoustic and related products around the world and refine our existing products. Our research is primarily conducted internally. We employ approximately 400 employees worldwide in research and development. Our research and development efforts continue to expand the technology platforms that support our customers’ product and business development. By applying interrelated technologies to the design processes, we strive to enhance and accelerate our customers’ initial concepts and design work, as well as provide for cost-effective component customization, manufacturing and subassembly. Research and development expenses are classified within Operating expenses. We spent $83.0 million, $82.6 million and $77.3 million on research and development, or 7.3%, 6.8% and 6.9% as a percentage of revenue, for the years ended December 31, 2014, 2013 and 2012, respectively.

Fast product development cycles and high volume manufacturing capabilities are crucial mechanisms that the company utilizes to stay competitive. To do this, Knowles invests in research and development and has increased increased its R&D spending by over 50%, to nearly 7% of the top line over the past three years.

Valuation

Free cash flow to the firm after reinvestment for growth will generate a NPV cash value of 12/share over the next 5 year. If the company were to be considered an acquisition target in 5 years to a strategic buyer would see easily see a 5-7 times EBITDA multiple(Taking into consideration the Valeant business model becoming popular when Bill Ackman came into play as Michael Pearson and Bill teamed up to acquire Allegran 7x EBITDA would be a starting point.) With 5x EBITDA, market valuation should be $3.1 billion or $37/a share. For a strategic buyer to propose a 5x multiple, reasoning would be that Knowles market share decline is more pronounced in the future than anticipated and further product deficiencies remain unmanageable.

Against a competitive peer, AAC Technology Holdings, on an EV/Rev basis, AAC trades at roughly 6.5x on EV/Rev and adjusting the multiple against PCB prime rate(~5.35%) and the FED Reserve prime (3.35%) would require us to rerate the multiple for Knowles to 10-11x revenue. Remaining conservative Knowles revenue of $1.14 billion would give us a current valuation a little over $90(Too much speculation on Wall Street shouting for FED rate hikes though I doubt a rate hike will occur in 2015 better to err on the side of conservatism). What is not being factor in is the wearable technology market and the growth of the specialty components division due to growth in hearing aids and other medical use for the aging baby boomer population which has yet to take full stride.

Catalysts

- announced cash distribution of excess capital three years out

- more likely: a combination of share buybacks and an acquisition strategy similar to the Valeant acquisition model 1-2 years out.

Risks

Knowles is highly exposed to loss-of-customer risk.

Continued product deficiencies

- Macro currency pricing potentially affecting near term 2015 earnings

I have no positions in the above company mentioned, but may initiate a long position over the next 72 hours.